to sort out poverty:

a chance from microcredit

International Seminar

9th and 10th of April, 2005 - Cairo

| Social Loan Tracking System |

|

PAP panel |

||||||||||

|

PAP Panel

The Italian - Egyptian Poverty Alleviation and Employment Generation Program (PAP) By Ms Lourdes Habash and Dr Carlo Volpi

The Egyptian-Italian relationship is deeply rooted. Poverty Alleviation and Employment Generation Program (PAP) comes as an evidence of this special friendly relation that unites the two countries. It is the outcome of a grant given by the Italian government to the Egyptian one, which came into action after both the Italian Ministry of Foreign Affairs and the Egyptian Ministry of Insurance and Social Affairs (MISA) had signed the protocol on September the 9th 1997.

At the outset, PAP was implemented in the Giza Governorate with an overall duration of three years. Due to the success achieved and in order to spread the services among other Egyptian communities, the Program was expanded by including Minia Governorate on January the 13th 2001, while the joint management was extended to both governorates to last till March the 31st 2005. PAPís main tool is a microcredit scheme that is used to support new or existing income generating activities, not only financially but also by providing technical assistance in order to effectively carry out the projects presented by the beneficiaries.

In line with the previously mentioned objectives, facilitating the procedures of target groups to loan access has been considered a priority of the Program, as those groups are usually considered "non bankable" by traditional financial institutions. The Program has been implemented in 12 CDAs in Giza and 16 CDAs in Minia.

Starting to work with CDAs in Giza

PAP started working with 5 CDAs in Giza in June 1998; so far, that program has reached the number of 12. The CDAs were chosen out of 66 Associations with the cooperation of MISA according to the following criteria:

Entrusting CDAs Each CDA signed an agreement coherent with the Program objectives before starting its activities. In each of them, a "credit loan unit" has been created: it consists of two field officers - one working as a treasurer and the other as an accountant - to whom one volunteer is added.

Each CDA started its activities on an initial grant of 300,000 EGP. This money transfer continued according to the ability of each CDA to manage the loan disbursement and the repayment rate till they reached the break even point, which means the moment in which the revenue equals the operational expenses.

The CDAs thus have become sustainable and are been able to carry out their activities without receiving any financial support from the Program.

All the CDAs in Giza have reached their break even points, the first two being Mazgouna and Abu Al Nomrous on June the 1st 2001 and the last ones being Madinet Al-Tahrir and Omal on April the 1st 2004.

Extending the Program On November the 30th 1998 MISA requested the expansion of the Program to Minia Governorate. According to the agreement, the Program was implemented in Minia with 16 CDAs which were chosen according to the same criteria used in Giza.

PAP is a microcredit program the main tool of which in alleviating poverty is the revolving loan scheme. During the working years with its beneficiaries the program recognized some of the social needs, not available in the targeted areas, that could be satisfied by the Program.

Accordingly, the Program offered new services which meet the needs recognized and which are in line with its goals of fully serving the community. The services offered could either be in the form of loans or grants.

These services could be listed as follows:

Capacity Building The Program believes in the importance of human resources. For this reason it included in its plan the provision of training and capacity building activities for PAP staff, MISA employees, the staff working in credit units and CDA staff. In addition, it provides vocational training to help the beneficiaries run their activities efficiently.

Program Policy Revolving loan activity Ever since the first day the Program took into consideration the issue of sustainability. Accordingly, a revolving loan scheme has been designed and employed by the Program. It has thus been necessary to draft a policy balancing between reaching the poor and giving the chance to a larger number of beneficiaries to loan access. The Program policy regarding loan sizes and stages is in line with the Programís objectives.

Sizes and Stages:

Starting from LE 200 up to:

The criteria are:

After revising the social situation and preparing the feasibility study for the project, the beneficiary gets the approval from the Loan Committee if he/she is eligible.

Special attention is paid to:

Repayment Method Loans are repaid in monthly installments. The repayment duration cannot exceed 18 months, with a possibility of six-month grace period. Loans are disbursed with an 11% annual flat interest rate.

Social Loan Tracking System (SLTS)

With the aim of

finding an accurate method for data collection, for follow up and for

monitoring, PAP uses a Social Loan Tracking System, a program that uses

Open-source is a technology "made by the people for the people" and shares an ethical view with microcredit; this is one of the reasons why it has been chosen by PAP. The system can also be shared with other microcredit Programs active all around the world.

At the beginning, this program needed to be tested. The choice fell on the CDA of Desamy, data of which entered the system as a pilot test. This was very useful in order to understand problems and difficulties, and after making several modifications on this program it started working efficiently as a network and CDAs started to send their data through the system to the headquarter.

Through this system, the program guarantees that the data of the 28 CDAs, the two regional offices and headquarter integrate in one system. PAP Methodology Book This book provides information on one of the best microcredit practices in Egypt, and it contains rules for action on how to manage a revolving loan activity. What makes it so special is that it is the first of its kind.

It contains the entire administrative and financial rules to record all the dealings that are related to the credit program, to guarantee that these loans will actually reach the target group. In addition, it helps in unifying all the concepts for all those who are working with the Program, specifying the roles and responsibilities for an easy implementation and an internal monitoring of the operational steps. This helps to measure the results of the Program and develop its effectiveness.

As the CDAs play an essential role in implementing the policy of the Program, it was important to address the content of the methodology book to them. The book thus tries to help CDAs in planning microcredit activities and decision taking so as to broaden their services and better understand the basic strategic planning of the Program.

'PAP Methodology Book' is a tool that guarantees transparency and internal monitoring which are the essential principles for the sustainability of the Program.

The Federations The two federations in Giza and Minia are considered the main actors that support the sustainability of the revolving loan activity.

Sustainability comes in accordance with article 51 of law 48, 2002 which rules CDAs and NGOs and encourages the cooperation of CDAs working in the same field. Thus the Federations are in charge of institutional capacity building of the CDAs members in order to enable them to manage the disbursing procedures and cash-flow, to follow up the activities efficiently, as well as to assess the various communities' needs and to publish a list of the member-CDAs in order to introduce their activities to the citizens. Small Enterprises & Community Development Association (SECDA) As a tool to promote socio-economic development, the Program employs:

The Program overall objective regarding the market-oriented component is to reinforce economic growth and to generate new job opportunities by supporting the small and micro enterprise sector through the network of the Community Development Associations (CDAs).

SECDA has the following specific objectives:

In September 1999, SECDA signed two agreements, one with PAP and one with the Credit Guarantee Company (CGC) to implement a credit program for the micro entrepreneurs in Giza Gavernorate.

PAP provides support to the action of the Egyptian Government through the Ministry of Insurance and Social Affairs (MISA) in reducing poverty and creating job opportunities in order to soften the effects of the Economic Reforms and the Structural adjustment program. PAP responsibilities are assessing the training needs of SECDA, monitoring and following up the loan disbursement and repayment, conducting and organizing internal and external audits in collaboration with the CGC for small scale enterprises.

The CGC is responsible, in collaboration with PAP, for identifying banks willing to provide a credit line to SECDA for the disbursement of loans with leverage up to three times the guarantee fund and must not exceed the sum of 7,5 million LE.

The overall objective of the Program is to support Egyptian economic growth and create new job opportunities. The specific objectives are:

The target beneficiaries are the micro-entrepreneurs in Giza Governorate which employ up to six workers and which have field capital value ranging from LE 2,500 up to LE 40,000, from which land and premises are excluded. Although all kinds of business activities are favored, particular attention is given to manufacturing, craftsmanship and service enterprises, as they are labor-intensive activities.

SECDAís activities include:

Organizing workshops, seminars and meetings to exchange experiences and information with other organizations working in the development field. The loan ranges from a minimum of LE 5,000 up to a maximum of LE 50,000. There are five loan categories or loan cycles. In each cycle, the amount is repaid in fixed periods. However, also applications for loans beyond the third cycle are taken into consideration, if needed, according to the feasibility study. Depending on the feasibility study and cash flow statements, the repayment period varies between 12 to 24 months. SECDA allows a grace period of not more than three months, according to the needs of the project.

Dr Amjad Yaaqba, former Director of Italian - Egyptian Poverty Alleviation Program

This Program was established by the Italian Cooperation as a bilateral grant program. The first project management unit was composed by Dr Lorenzo De Prosperis, in cooperation with professional Egyptian partners. They started coordinating with local community organizations and Federations, showing since the beginning that the most important indicator for this project was the network, which proved these results. These have been also reached thanks to the hard work of the staff involved in every CDA: field officials, tellers, accountants and volunteers, and five members of the loan sector.

In brief, we are talking about eleven individuals involved in each CDA, and we cannot compare the successes of this project with any other project without taking into consideration that there is a significant number of individuals in each project whose salaries are covered entirely by the microcredit allocated interest: this is called sustainability, which, besides the deep involvement of local communities, who became actors of their own development and were empowered by the Program, is the most significant aspect of this project.

Throughout the two years I spent in Cairo as the Director of PAP, I visited the Federations many times, benefiting from this experience. Federations and CDAs members, work very well on a very simple economic theory, that is, how small amounts of money can be used to establish enterprises, and I believe that it is one of the power points of this project.

The project went through three main stages. The first one was the research for the initial grant and sustainability. I remind you that the innovation of microcredit is in offering loans to financially excluded individuals and not in providing subsidized facilities to poor people. These people are usually willing to pay an interest rate on receiving adequate services.

The second stage regarded the technical continuity, which is the ability of the Federations to manage and monitor this project.

The third one looked on the institutional and legal continuity which leads to an operational unity among these Federations.

All the three above mentioned stages were facilitated by the drafting of a manual. I would like to mention a couple of prominent members who participated in setting up this guide: Mr Wael Gamal, who designed the financial section in that guide and Mr Mohsen and Mrs Maha Salem, who contributed to its preparation, and I would like to thank the two of them. Of course, this guide is an important document which guarantees the continuity and achievement of the expected results. Moreover we seek to go on, whether this development or that continuity will depend on managing the Program itself and on distributing it to other CDAs, or on extending the project through the disbursement of a higher number of loans.

The manual clearly states the structure of each assembly: a loan committee, officials and professionals. In addiction, the Federations should provide the distribution of work force and to do this it has to be therefore provided with a proper mechanism and a serious plan to spend these loans in an effective way.

Most of all, loans are considered to be used in a proper way when their output takes into consideration social activities aiming at improving the communityís quality of life, such as a library, a cultural centre, water and sanitation interventions and so on. This is a brief summary of the social activities and initiatives implemented with the project. The project is doing its best in order to support the absolute priorities for the community.

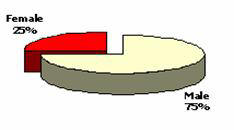

The project disbursed 37,000 loans till the end of December 2004 and the number is increasing in line with the functioning of the revolving funds. We made it clear that the percentage of women beneficiaries has to increase and is increasing.

Thank to the procedures followed by PAP, not only the gender perspective is acquiring more and more importance, but also the repayment rates are high and new people approach the Program every year. At last, I would like to thank those who prepared this seminar, and thank them for inviting me and asking me to present the Program. Dr Mohamed M.H. Saleh - Director of SECDA (Small Enterprises Community Development Association)

Good morning. As a non-governmental organization, SECDA was established in 1999, and then notarized at the Ministry of Social Affairs. Its establishment was completed under the supervision of the Italian International Cooperation and Egyptian Poverty Alleviation Program. As SECDA, the market oriented component of PAP, we are responsible for the implementation of the component of the small loans.

The NGO SECDA is a public assembly, and its main component is the General Assembly, which started working with 35 founders and reached 47 members at present day. Among them seven members from the General Assembly are elected for the board, while its executive staff has 12 employees and 4 specialized committees through which we manage the mission of SECDA. The market oriented component was established under the agreement between the Italian Poverty Alleviation Program and the Ministry of Social Affairs and the Credit Guarantee Company (CGC).

The Program started with EGP 2,6 million financial support and, as the amount of the loans disbursed through SECDA, which has a different target, is a little bit higher than that financed by PAP (starting from 5,000 to 40,000 EGP), at first we concluded an agreement with the Credit Guarantee Company to enlarge the outcome of the Program and to assure the maximum benefit for a reasonable number of beneficiaries.

As stated before, the loans cover an average amount ranging from 5,000 to 40,000 EGP distributed to five loan categories. In five years we disbursed about 2,512 loans which equal 33,5 million EGP, and throughout the five years we have made 4,600 studies and visits on the field to microentrepreneurs, while by the end of 2004 we achieved a percentage of repayment of 98,4%. Moreover, we are financing three sectors: commerce, services and industrial production.

We are covering the Governorate of Giza entirely and focused our activities on 6 other areas: El Haram, Faysal, Imbaba, Boulak, El Omranya and South and Mid Giza. The association reached its break even point on July, 2001, 18 months after the beginning of the project. I would like to seize the opportunity of the end of the first phase of the Italian Program in Egypt to thank all of you.

I would like to underline a very specific characteristic of PAP microcredit scheme: the loans (in kind, not in cash) are given to beneficiaries after the social worker field officer and the beneficiary have identified the project.

The field officer then meets a purchase committee, and at this stage, the beneficiary receives his/her loan, starts his/her activity and repays it in cash. The repayment is based on the capital plus an interest, which is a flat rate interest that ranges between 11% and 14%, according to the kind of loan, is paid back to the CDA which reinvests the money in new loans.

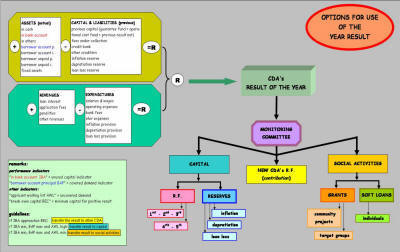

This methodology of managing microcredit by the CDAs themselves and not by commercial banks allows the revolving fund to grow fast in producing a surplus which is used both for increasing the capital and for social projects in the same community (see diagram on the next page).

The Program, after seven years, and before the handing over of the management and the implementation activities to the Egyptians, has promoted the establishment of the Federations of CDAs both in Minia and in Giza. So the role of the Federations will be exactly the one that comes out from this debate.

Federations were created to guarantee the flexibility of the management of the revolving fund and to guarantee the establishment of the facilitatorsí roles that can accommodate and manage all the problems, and can provide enough training for the CDAs whenever new ideas and methodologies have to be applied.

A1 - On the 7,5 million loans, the interest charged by the bank is 12% while on the 2,5 million Guarantee Fund the bank only charges the expenses.

Q2: What is the role of the Credit Guarantee Companies for you, as an association? Can you work directly with the bank and deposit the money there?

A2 - The main role of these companies is to guarantee the credit section. With a deposit of 2,5 million, no bank will open a credit line exceeding a percentage of 92% of this deposit. For old clients this percentage could reach100%. On the contrary the Guarantee Companies, as a group of banks, cover the risk for three times the deposit, so paving the way to serve more beneficiaries with loans.

Q3: Do these companies receive an interest from the deal?

A3 - They do take a commission, not an interest: their commission is 25% from the deposit interest. And they also take what is equal to 1% from the highest debt of the credit line deducted from the deposit interest.

Q4: I received loans more than once. Can I receive one more loan even if I am older than 60? What happens if I take the loan but I pass away before I can repay? What are the responsibilities of my children in this sense?

A4 - You said that you borrowed from the Association of lmbaba, so if your activity is still working, you can come to us in SECDA, because we allow people from 60 to 65 years to receive loans.

The main idea of the project is to reach the individual who is expanding his/ her activity. Moreover, on the bases of studies we have carried out, we assume that the three or five stages will enable the individual to continue develop and transfer his potentials and his activity through SECDA, which allows more loans than the average. This way the beneficiary will therefore be in no need of new loans, because at this stage the income and the activity can finance itself independently.

When we talk about PAP we must remember that the targeted category for this project was established for assisting the very low income people in order to give them a chance to live in dignity and honor; so we must follow the objectives of this project, and then the beneficiary can learn to apply for loans in other banks or institutions.

So, the project is a competitor for banks but it applies to categories which cannot reach the banks because they are the weakest ones in the society. On the other hand, if someone comes to me to get a loan, and every time he/she repays it, he/she goes on by taking more and more loans, since he/she is able to repay the association. Finally he/she will be able to take a loan from the traditional financial sector; this way microcredit will for sure to reach the goal of fighting financial and social exclusion. In addition, no project should be static; of course we have to solve all kinds of problems we could face during the execution of the project. At the moment we are studying these kinds of problems and we might find solutions. I think the main reason of these problems is due to inflation and the loan size (which is still the one of five years ago), will probably not meet the beneficiaryís needs. So, according to what the mechanism can produce, the CDA may decide to increase the loan size to actually address this kind of problem. There is a big flexibility in the mechanisms of microcredit, the important thing is full consensus and full participation of people in addressing problems and finding solutions. |

Social

Interventions

Social

Interventions

Anyone who meets the

following criteria can apply for a loan from his/her nearby CDA.

Anyone who meets the

following criteria can apply for a loan from his/her nearby CDA.